Editor's Note: Charts have been updated so that they do not extend beyond March of 2019. The author failed to use archived sources, so some citations have needed to be resourced. Beyond the citations, the charts, and where otherwise indicated, the 2019 article remains unchanged.

History repeats itself, as the saying goes. While many aspects of today’s speculative valuations of Bitcoins and its underlying blockchain technology are unprecedented, we need not turn the pages of history back too far to find a similar situation: the infamous Dot-Com Bubble. Bitcoin’s value and the Dot-Com Bubble share many noteworthy similarities. Before I get into these similarities, I will provide a brief history of both the Dot-Com Bubble and Bitcoin’s value.

The Infamous Dot-Com Bubble

People that have been using the web for years are likely familiar with the Dot-Com Bubble. I remember seeing a listing on eBay for freeiphones.com for $10,000,000. In short, investors got a little bit carried away with their valuations of new technology. In this case, the World Wide Web. The World Wide Web was invented by English scientist Tim Berners-Lee in 1989. It was not long before business folks and investors became interested in this new technology. According to Ian Peter, “Between April 1992 and July 1993, all of the major US business magazines had published major features on new communications and the ‘Information Superhighway.’ … Business Week’s July 12, 1993, edition had a cover story ‘Media Mania… digital - interactive - multimedia - the rush is on.’” Amazon was founded in 1994; Craigslist, Yahoo and eBay in 1995; eToys in 1996; Pets.com and Google in 1998; and Webvan (an early player in the online grocery delivery space) in 1999. “Super Bowl XXXIV in January 2000 featured seventeen dot-com companies that each paid over two million dollars for a thirty-second spot.” Investors went wild as these companies promised to revolutionize society at large; however, the good times could not last forever. “Over 1999 and early 2000, the Federal Reserve had increased interest rates six times, and the economy was beginning to lose speed.”

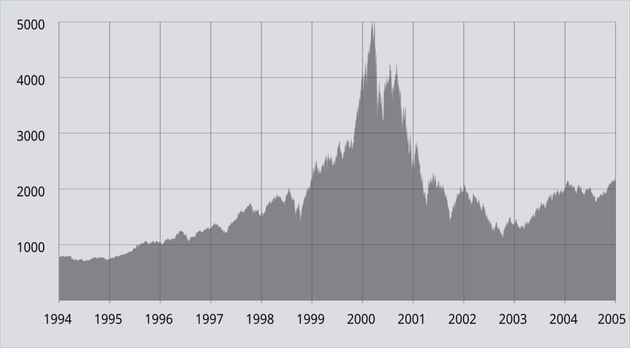

NASDAQ Composite price history from 1995 to 2005

On March 10, 2000, the Dot-Com Bubble reached its peak as the NASDAQ Composite index peaked at 5,048.62—more than double its value from March 1999. On March 13, 2000, the market opened 4% lower than it had closed on Friday. Pets.com closed in 2000, and Webvan and eToys closed in 2001. Super Bowl XXXV, played on January 28, 2001, featured just three dot-com companies (Worldhistoryproject.org.) According to Money Crashers, “the market crash cost investors a whopping $5 trillion.”

History of Bitcoin

From Historyofbitcoin.org: “According to legend, Satoshi Nakamoto began working on the Bitcoin concept in 2007. While he is on record as living in Japan, it is speculated that Nakamoto may be a collective pseudonym for more than one person.” Bitcoin.org was launched in August 2008. Bitcoin’s whitepaper was published in October 2008. Bitcoin was published to SourceForge in November 2008. The first block on the Bitcoin blockchain was mined on January 3, 2009. The first Bitcoin transaction took place nine days later on January 12, 2009, between Satoshi Nakamoto and Hal Finney. Bitcoin’s first exchange rate was established in October 2009, when “New Liberty Standard published a Bitcoin exchange rate that established the value of a Bitcoin at US$1 = 1,309.03 BTC, using an equation that included the cost of electricity to run a computer that generated Bitcoins.”

Bitcoin price from 2014 to 2019 courtesy of CoinGecko Bitcoin price from 2014 to 2019](/static/f828915f665592c2e0a3e0e06a3488f6/984b6/bitcoin-price-chart.png)

By March 2012, the new protocol attracted the attention of hackers. “A security breach at Linode, a website hosting company, resulting in the largest theft of Bitcoins recorded to date. More than 46,000 BTC were stolen, valued at over US$228,000.” By April 2012, the FBI became interested. " An April 2012, FBI report entitled Bitcoin Virtual Currency: Unique Features Present Distinct Challenges for Deterring Illicit Activity was leaked and brought attention to concerns that Bitcoin payment methods could facilitate illegal transactions for weapons and narcotics." Neither of these factors stopped people from buying Bitcoin. On December 18, 2017, Bitcoin reached its all-time high at $19,498.63 (99bitcoins.com; Update: CoinGecko lists the price from that day at $19,423.58.) Regulatory intervention and the banning of cryptocurrency-related advertisements by Facebook and Google may have contributed to Bitcoin’s subsequent fall. Today, Bitcoin is valued at $7,407.58, according to xe.com.

Similarities Between Bitcoin and Dot-Com Domains

What do these two bubbles have in common? First, like all bull market bubbles, they inevitably burst. Second, there is still tremendous value in both dot-com domains and Bitcoins. 1stmortgageloans.com is for sale by My Web Address for $25,000. 1stmortgageloans.net, on the other hand, is available on namecheap.com for $12.98/year. (Update: My Web Address is no longer online, but namecheap has mortgagetestimonials.net listed for $12.98 annually, and mortgagetestimonials.com listed for $2,288.00.) Bitcoin is not going away. As governments continue to print money with no end in sight, traditional currencies are not going to get any more valuable any time soon. Bitcoin, on the other hand, has a finite supply. Its value relative to the dollar will likely soar for years to come.

—Stephen Corya